Cashapp Balance – Everything You Should Need to Know

The modern-day world is making everything convenient with digital currency and quick ways to exchange money in digital formats. Now, it might seem like a risk and inconvenience to carry a pile of cash in your wallet, which is why people are switching to e-wallets like Cashapp. Cashapp is a popular e-wallet service circulating in the American region, which provides users with a balance feature.

To explain the features and capabilities of Cashapp, we have compiled this detailed guide on what Cashapp balance is and how you can use it. We will also share some useful guidelines for using this app so you can get the best experience out of this e-wallet service.

Cashapp Balance – A Brief Explanation

Cashapp Balance is the amount of digital currency that users can deposit in their Cashapp account. This credit can be transferred to another bank account, and you may use it just like regular money using your phone application or Cash Card.

In simple words, Cashapp is your digital e-wallet that works much like a digital credit saving and makes transactions online. So, for instance, if you signed in to this e-wallet with your account on an iOS device, you may sign in with the same credentials on an Android device as well.

How can Cashapp Be Better than the Apple Pay Service?

Cashapp is more convenient and famous than Apple Pay because of its compatibility and potential. Apple Pay can only be used on iOS devices, which makes it a limited option for Apple users only. While it is limited to a very specific audience, Cashapp extends to a wide range of operating systems and devices.

You can use Cashapp on iOS, Android, Windows, Linux, or any other operating system that has firmware after than 2021 software. Hence, due to a wide range of support for devices, it has become more popular among users than the conventional Apple Pay service.

Cashapp Pros and Cons

How to Check Your Cashapp Balance on a Mobile Application?

Here, we have mentioned an easy step-by-step guide on how to check your Cashapp balance using the mobile application.

- Open your Cashapp mobile application and sign in with your credentials. It will send you an email verification on your email that you will provide.

- Verify your email and sign in to the application.

- At the bottom left side of your screen, you’ll see your Cashapp credit or Cashapp balance listed in the Money tab. Click on the $ sign, which will showcase your balance in USD.

- Alternatively, you can check your Cashapp balance online by visiting cash.app/account.

Note: Call Cashapp customer support at (800) 969-1940 to know your Cashapp balance.

What is a Cashapp Card?

The Cashapp card is your solution for withdrawing money from ATMs and making contactless payments at stores. You may use the Cashapp card for online shopping, which works much like a debit card to withdraw money and make online payments.

This card is an idea of the Sutton Bank, which is why it is acceptable at any place where the Visa Card is accepted. Even though this card can be issued by a different bank which allows you to make payments at it, and it works similarly to any prepaid debit card.

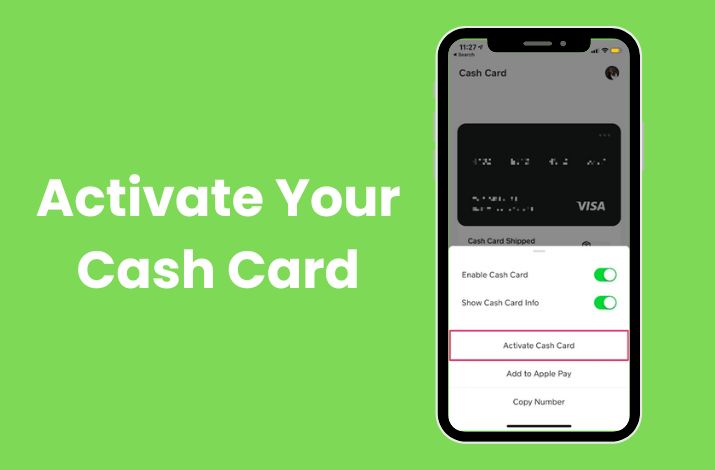

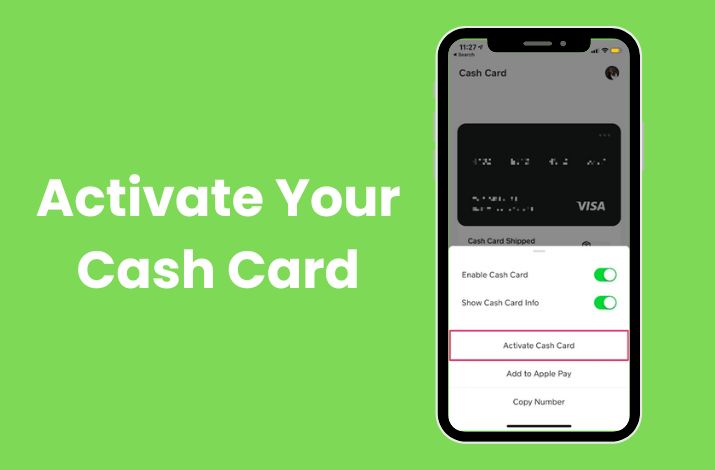

How to Activate Cash App Card?

There are two different ways to activate your Cashapp card, and you can follow any of these step-by-step methods depending on your preference.

Activate Cashapp Card on Phone

To activate the Cashapp card on your phone, you will need the QR code that comes lodged with your card when it is delivered. Here is how you can activate your card by using your smartphone.

- Select the ‘Activate Cash Card’ option from the menu.

- Allow the camera to access the QR code scanning.

- Scan the QR code from the packaging of your Cash Card.

- Within seconds, your card will be activated, and you can use it to withdraw money.

Activate Cash Card with Card Details

If you lost the QR code, no worries we have your back. You can follow these steps for card activation.

- Open the Cashapp application on your smartphone.

- Tap the Cash Card icon and select ‘Activate Cash Card.’

- Select ‘Missing QR code’ from the menu.

- Select the option ‘Use CVV instead.’

- Enter the CVV code from your card and provide the name, expiration date, and CVV to ensure.

- By doing so, in no time your card will be activated.

Summing Up

Cashapp balance is a much more convenient way to keep tabs on your money in the e-wallet. The process is pretty simple, and it takes only a couple of minutes to check the balance and share it anywhere in any bank. This e-wallet enables you to store your money in digital formats and allows you to make online transactions. Hopefully, this guide has helped you check your balance from Cashapp, and it works with other e-wallet services.

FAQs

Q1- Can I pay internationally through my Cashapp?

No, you can’t pay internationally through your Cashapp account because it doesn’t affiliate with international banks.

Q2- Can I check my Cashapp balance without its application?

Yes, you are free to check your Cashapp balance without having its application on its official site. Alternatively, you can get assistance from its customer service which is (800) 969-1940.

Q3- Can my balance go negatively?

Yes, your Cashapp balance can go negative due to additional tips and secondary charges.

Q4- What is the transactional limit in Cashapp account?

A normal account can transact up to $10,000 in a month.

Q5- Can a 13-year-old have a Cashapp account?

Yes, according to Cashapp account policies, a 13-year-old can create an account on Cashapp and store his/her money.